Most of us in the world today own a bank account where we save our money. We deposit our pay cheques at the end of the month, and see some numbers getting added to the sum in our account on the banking app. But what happens with the money that is deposited?

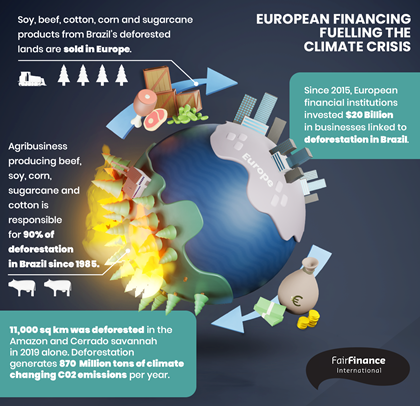

Is it being used for manufacturing weapons? Is it being used for destroying forests? Or is it being invested for social housing projects? Most of us will not have an answer to these questions. What happens with the money, where it goes and what investments are made with it, often remain unclear to the bank customers. But Fair Finance seeks to transform this by bringing in accountability and transparency in money transactions and investments by banking institutions.

Fair Finance: Concept and Objectives

While there is no agreed definition of fair finance, it can be regarded as a financial systems in which the various financial products like savings bonds, fixed deposits and bonds are now being used for sustainable investments which are fair and just in nature.

The objective of fair finance is not only to offer returns and security, but it aims to pursue goals beyond the financial world through sustainable investments. The investments are supposed to be ecological, ethical or social. Some positive impacts of sustainable investments can be better environmental protection, reduced child labour, improved working conditions, and decreased wage discrepancies between genders.

Quick Fact: What if there is no Fair Finance?

Not knowing where our money is being invested by big financial corporations can be dangerous. In December 2020, the Netherlands Fair Insurance Guide has reported that big firms like Aegon, Nationale Nederlanden and Allianz are investing billions of euros in the controversial arms trade. (Source)

In fact, the largest investor among the three companies is the German insurer Allianz. With about 1.3 million customers in the Netherlands, Allianz has invested 3.8 billion euros in fourteen arms companies that supply weapons to 49 countries that are currently engaged in armed conflicts that cause a serious violation of human rights.

Fair Finance International

Countries around the world mostly have different financial regulations which make standardisation of fair finance principles difficult. Nevertheless, Fair Finance International (FFI) is an international civil society network that assesses, reports, and campaigns for more responsible investment policies & practices.

FFI was initiated by one of the largest charitable organisations called Oxfam. It comprises of 70 civil society organisations that work together for strengthening the commitment of banks and other financial institutions to social, environmental and human rights standards.

After being initiated in the Netherlands in 2009, FFI is currently operational in 11 countries: Belgium, Brazil, Germany, India, Indonesia, Japan, Netherlands, Norway ,Sweden, Thailand, and Vietnam.

Five Reasons why we need Fair Finance

- Transparency: Fair finance makes adequate information available to the customers about what is being done with the money kept in the banks. This is important for ensuring transparency about financial flows within and outside a nation.

- Security of financial data: Banking institutions with a fair finance policy ensure that customers have the control on their financial data, which always requires their permission to be accessed. This can give the customers freedom to move accounts among providers.

- Accountability: Fair finance institutions conduct regular audits and periodic review reports which are available to customers to check on whether the banks are performing adequately on sustainable investment projects.

- Welfare policy: Fair finance is aimed at investing on projects that are 'fair' in nature, and advantageous for the society and the environment. Customers who invest in fair finance can be assured that their money will not be used for buying guns.

- Customer-centric policy: Fair finance institutions put customers at the centre of decision making, and ensure that their services are tailor-made and flexible, according to the needs and wishes of the consumer.

Fair finance provides us with an opportunity to save our hard earned money with a clear conscience, and helps us in doing our part in promoting a just world. To know more on ways to help build an environmentally friendly and socially equitable world, visit the solutions page from seventeen goals magazin, that offers many solutions on how individuals can initiate positive change.

For getting more information about how and where to open a sustainable bank accout, visit our info page

Header Picture: Artem Beliaikin, Unsplash